Research Projects on FinTech

- Financial Portfolio Management by Leveraging Deep Reinforcement Learning (DRL) and Large Language Models (LLMs)

- DySTAGE: Dynamic Graph Representation Learning on Asset Pricing via Spatio-Temporal Attention and Graph Encodings

- RAGIC: Risk-Aware Generative Adversarial Model for Stock Interval Construction

- Prediction with Time-Series Mixer for the S&P500 Index

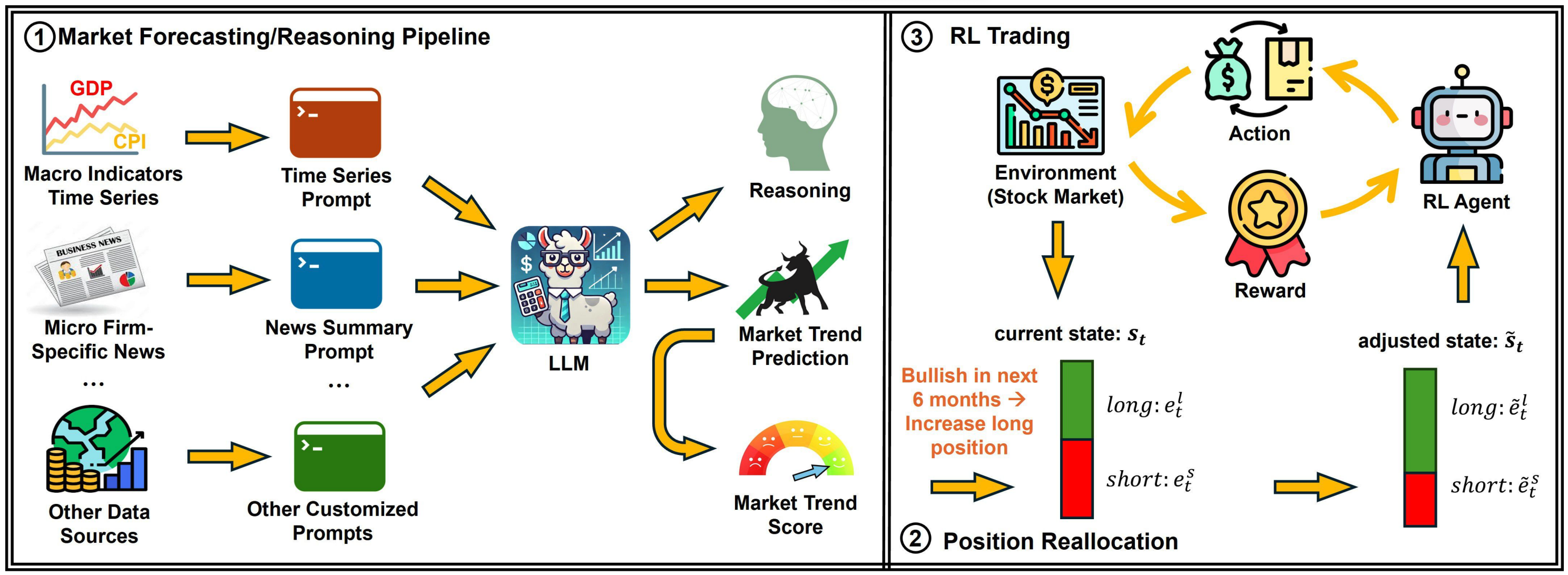

Financial Portfolio Management by Leveraging Deep Reinforcement Learning (DRL) and Large Language Models (LLMs)

We present a novel margin trading system leveraging Reinforcement Learning (RL) and Large Language Models (LLMs) in the field of portfolio management. Existing approaches mainly focus on cash-only trading, overlooking potential benefits and risks associated with margin trading, particularly in short sale scenarios. To address it, Margin Trader, an innovative RL framework, integrates margin accounts and constraints into a realistic trading environment, supporting both long and short positions. It not only maximizes profits but also manages risks effectively in both bullish and bearish markets, offering traders the flexibility to customize settings in line with market conditions, risk tolerance, and personal strategies. Additionally, to dynamically adjust portfolios between long and short positions in response to evolving market conditions, LLMs are incorporated to learn market trends from diverse external data sources, from financial time series to news, enabling a more explainable and transparent decision-making process with a clear reasoning path. Combining RL with the reasoning capabilities of LLMs significantly enhances market forecasting, strategy optimization, and overall performance in portfolio management.

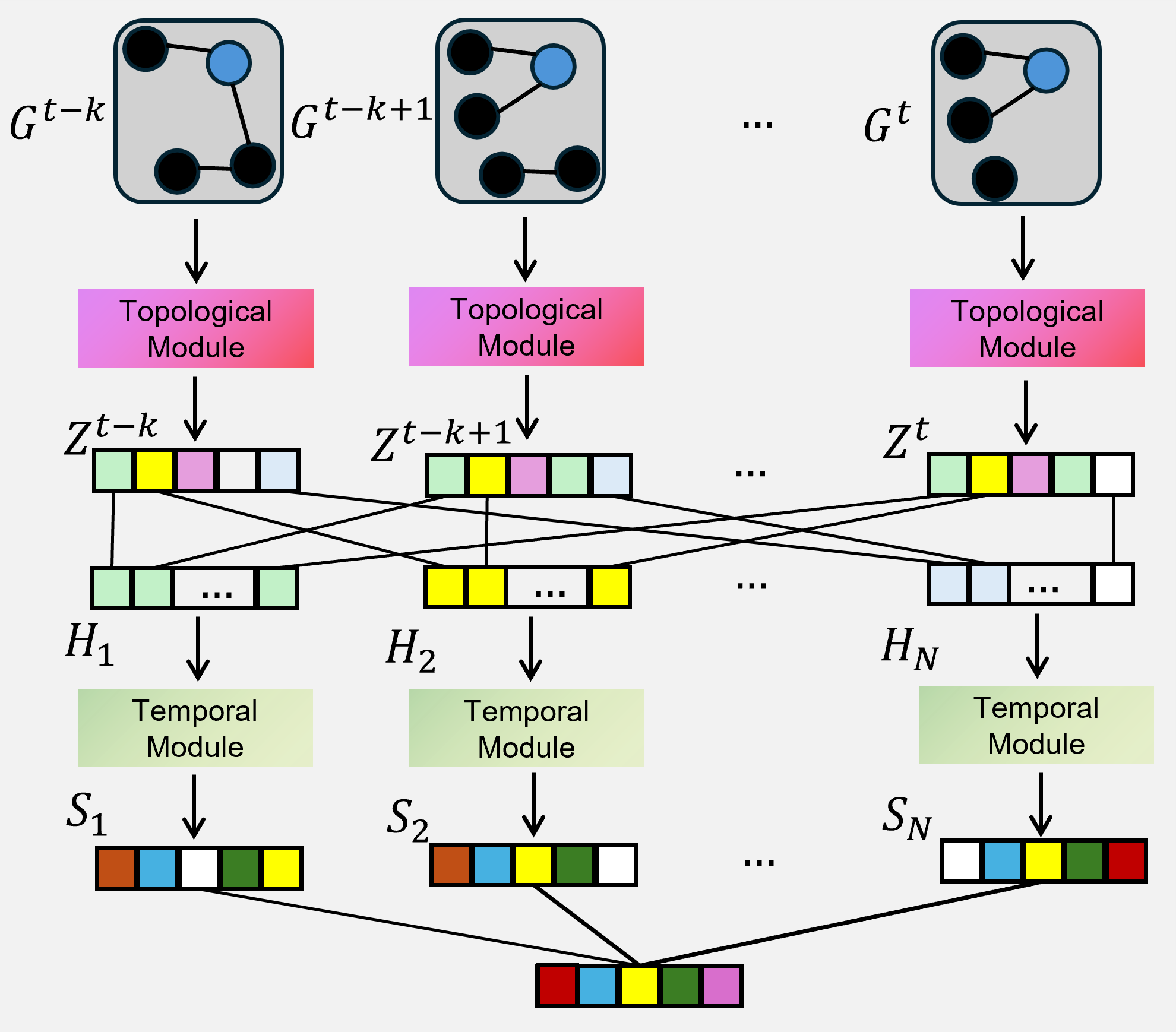

DySTAGE: Dynamic Graph Representation Learning on Asset Pricing via Spatio-Temporal Attention and Graph Encodings

We propose DySTAGE, a dynamic graph framework accommodating dynamic asset composition and evolving edge correlations. This not only enhances predictive accuracy but also supports informed investment strategies in an ever-changing market environment. In our framework, assets at various historical time steps are structured as a sequence of dynamic graphs, where connections between assets reflect their long-term relationship. DySTAGE leverages attention mechanisms to capture both topological and temporal patterns, and derives graph encodings to reveal financial patterns for price prediction on all existing nodes in future time steps. Extensive experiments on both dynamic and static asset data demonstrate that DySTAGE surpasses popular benchmarks on price prediction and offers profitable investment strategies in real-world scenarios.

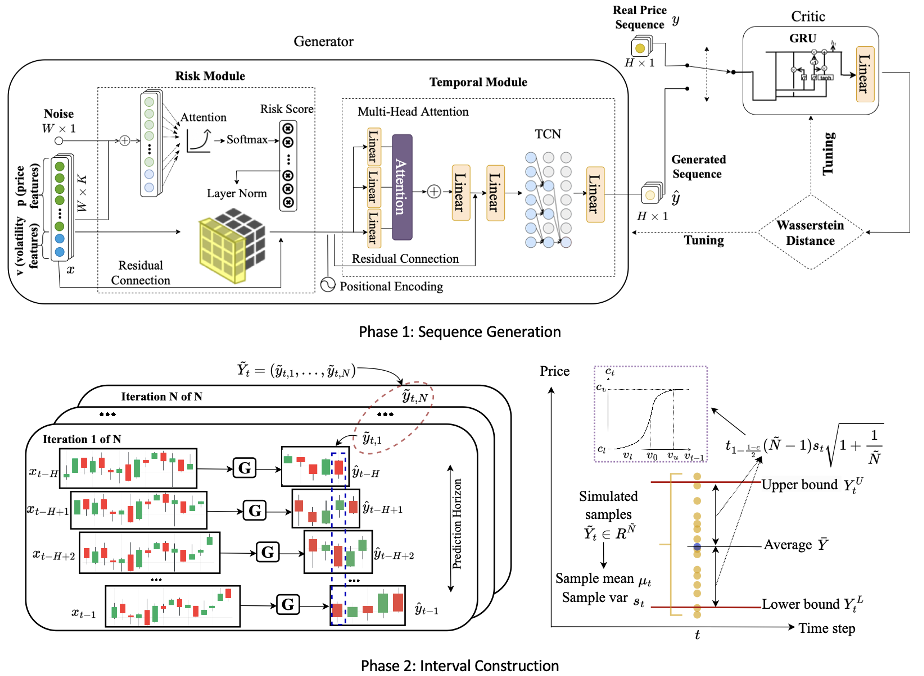

RAGIC: Risk-Aware Generative Adversarial Model for Stock Interval Construction

We aim to bridge the gap that many existing prediction approaches focus on single-point predictions, lacking the depth needed for effective decision-making and often overlooking market risk. Therefore, we propose RAGIC, a Risk-Aware Generative model for Interval Construction to quantify uncertainty more effectively. Specifically, RAGIC has two phases: sequence generation and interval construction. In the first phase, we employ a Generative Adversarial Network (GAN) to learn the historical stock features and simulate the future price sequences. The generator incorporates a risk module, which captures risk using a risk attention score derived from volatility index, and a temporal module, which captures the multi-scale trend expressed by historical prices. The well-trained generator can produce an adequate set of future price sequences with artificial randomness learned from the financial market. In the second phase, a horizon-wise strategy is designed to gather simulated sequences with different prediction horizons, and statistical inference is utilized to construct a risk-sensitive interval to reflect uncertainty, where the interval width is adaptively determined by the volatility index. In practice, RAGIC relies solely on publicly available data and incurs only low computational overhead. Extensive experiments on multiple stock indices world-wide illustrate that RAGIC achieves consistently over 95% coverage with reasonable interval width in a balanced manner.

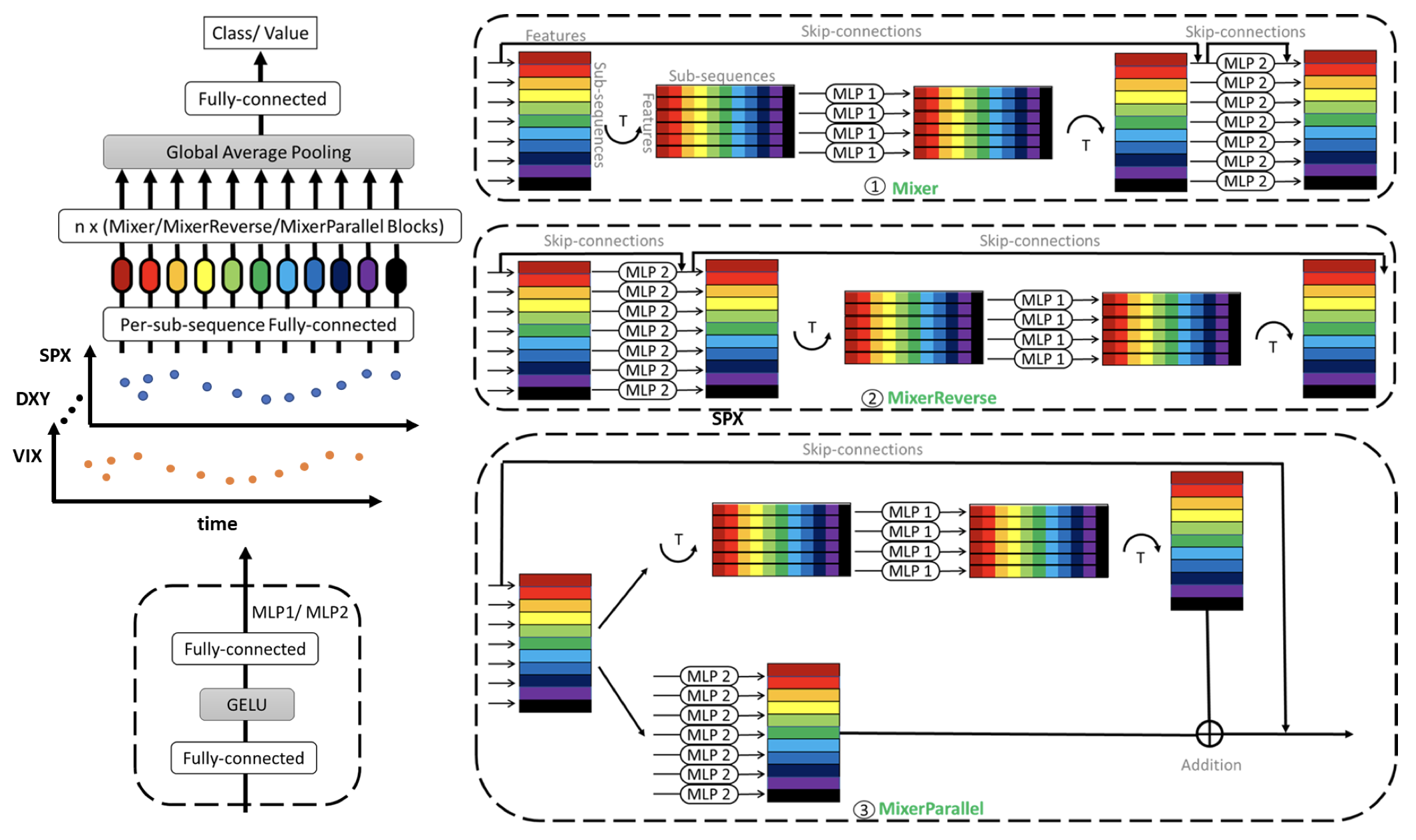

Prediction with Time-Series Mixer for the S&P500 Index

Time-Series Mixer (TS- Mixer) is the first attempt at an MLP-Mixer-based design for sequence modeling in stock forecasting. The central architecture of the TS-Mixer is inspired by MLP-Mixer, a competitive but conceptually and technically simple alternative that does not use gating structure, convolutions, or self-attention. MLPs in TS-Mixer are repeatedly applied to either per-location features or temporal features, which can be considered a novel method to capture temporal correlations. Like MLP-Mixers, TS-Mixer relies only on basic matrix multiplication routines, changes to data layout (reshapes and transpositions), and scalar nonlinearities. It contains two types of MLP layers: feature mixer and temporal mixer. The feature mixer is applied independently to each data point to capture the correlation among features. In contrast, the temporal mixer extracts temporal dependency (trend, seasonal, cyclical, or random characteristics) of each feature across the whole input sequence. The experiments on SPX in a high-volatility period demonstrate that our proposed TS-Mixer outperforms multiple benchmarks, including tradi- tional indicators, RNN-based models, and popular time-series models.